Southern California homeowners face growing insurance bills as climate-driven wildfires and seismic dangers mount. In recent years insurers have paid out record wildfire claims and prepared for bigger quakes, and these risks are reflected in higher Southern California home insurance costs. For example, industry forecasts show California home insurance premiums rising by about 20% or more between 2023 and 2025. Homeowners in wildfire-prone or quake-prone areas often find that coverage is harder to get and more expensive. Across the state, low-income owners and certain housing types (like mobile homes) already pay a larger share of income on insurance, and that gap can widen under stress. Many families are reconsidering both where and how to insure their homes under these threats.

Wildfire Risk and Home Insurance

Southern California’s wildlands and drought-prone forests make many neighborhoods highly vulnerable to fires. In recent years, devastating blazes such as the October 2017 Thomas Fire and the January 2025 Los Angeles County wildfires have caused billions in insured losses. These disasters force insurers to raise rates or pull back coverage in wildfire risk zones California-wide. For example, after the LA fires, State Farm obtained approval to hike premiums by about 17% on 1 million policies, and even sought a 22% increase on average to cover its losses. Insurers are increasingly non-renewing policies or refusing new business in high-risk areas, forcing many homeowners into the state’s FAIR Plan “insurer of last resort”.

California law now classifies many areas as fire “hazard zones” (based on topography, vegetation and history), and homes in those zones face surcharges or stricter underwriting. Insurers use resources like Cal Fire’s fire hazard maps to score a property’s fire risk. Homes surrounded by brush or hills often trigger higher home insurance wildfire risk ratings – meaning bigger deductibles or even outright refusal by some companies. This process can leave homeowners scrambling for coverage. The FAIR Plan, which only covers named perils like fire and usually pays actual cash value has seen policy counts jump from ~203,000 in 2020 to over 451,000 today. It now insures about $458 billion in home value, nearly triple the 2020 exposure. These numbers reflect how many Californians have been forced out of the private market.

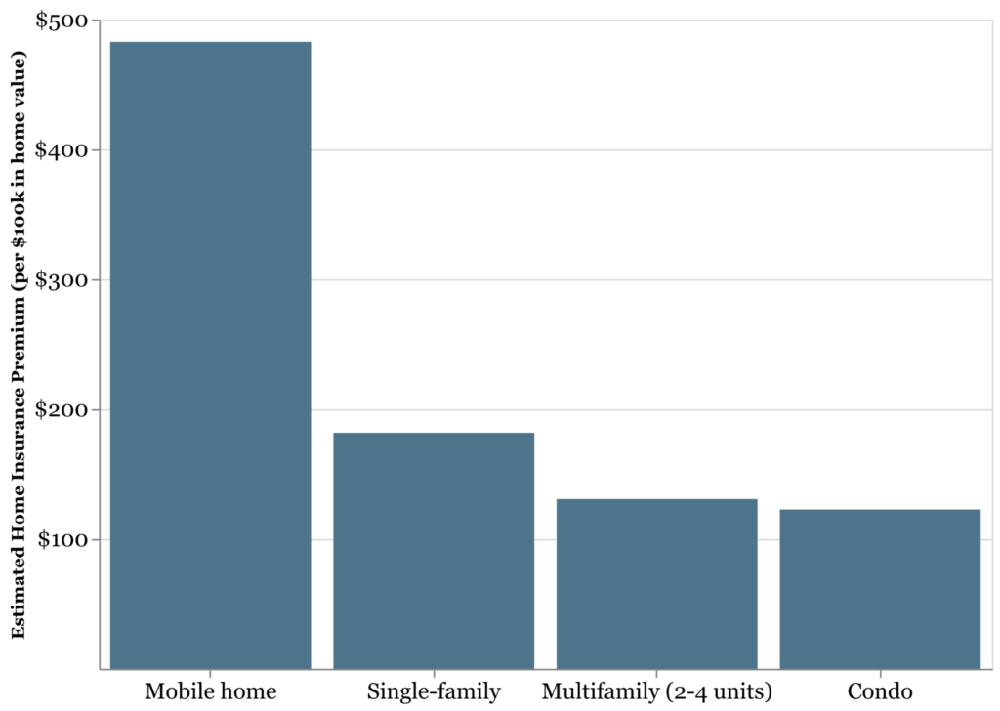

Chart: Home insurance premiums per $100,000 of home value by housing type in California. In California, insurance costs vary greatly with home type and value. Mobile homes can cost roughly $480 per $100k of value to insure, far above $180 for a typical single-family house. High wildfire risk is one reason insurance is so burdensome for owners of less-expensive or older homes.

After major fires, California regulators step in to protect consumers. For example, Governor Newsom issued a one-year moratorium on cancellations in ZIP codes hit by the January 2025 fires. The Department of Insurance later created new rules requiring insurers to use modern wildfire risk models and to keep writing policies in hard-hit areas. The goal is to stabilize coverage while reflecting how much homeowners have invested in fire safety measures (like defensible space and home hardening). These reforms should eventually slow the premium hikes and bring more competition back into fire zones.

Mitigation Tips for Homeowners: Insurers now often demand proof of fire readiness before renewing. Homeowners can take steps to both improve safety and potentially lower their rates. Key actions include:

- Create defensible space: Remove dry brush, dead trees, and wood piles within at least 30 feet of the home, and thin vegetation out to 100 feet if possible. Clear gutters and vents of debris so embers can’t ignite hidden fires.

- Use fire-resistant materials: Replace roofs with Class A fire-rated shingles or tiles, install non-combustible siding or stucco, and cover vents with fine mesh to block embers.

- Upgrade windows and doors: Install tempered or double-paned glass windows and solid-core metal doors. Ensure weather-stripping and seals are tight, keeping embers out.

- Landscaping and maintenance: Plant fire-resistant shrubs and maintain a green lawn near the foundation. Keep trees spaced and remove dead leaves regularly. Use gravel or stone ground cover immediately around the house as a firebreak.

- Water access for firefighting: If possible, have a water source such as a pool, pond or cistern and hoses that can reach all sides of the home. Some homes install outdoor sprinkler systems. Insurers tend to favor homes with ready water access for firefighting.

By taking these steps, homeowners not only reduce real risk but also may qualify for lower premiums or required “credits” under California’s Safer from Wildfires safety discount program.

Earthquake Risk and Insurance in Southern California

Earthquake danger is an ever-present concern across Southern California. The region sits atop major fault lines (San Andreas, Newport-Inglewood, San Jacinto, etc.), and history shows any big quake would cause massive damage. Unlike fire coverage, earthquake insurance Southern California is usually sold as a separate policy. Standard homeowner policies don’t cover quake damage, so owners must opt in if they want protection. This extra coverage is optional and often expensive, so take-up rates are low: only about 10–13% of California homeowners carry earthquake policies.

The California Earthquake Authority (CEA) provides most of the state’s quake insurance (covering over 1.1 million policies, roughly two-thirds of the market). To remain solvent, the CEA recently raised its rates. Starting January 2025, CEA policies saw an average 6.8% rate increase statewide. Some homeowners in high-risk spots (close to faults or with older wood-frame foundations) could see up to a 12% premium jump. The hike is driven by factors like skyrocketing construction and labor costs (with specialty trades in short supply) and steep global reinsurance price rises. In short, rebuilding after a quake is far costlier than it was a few years ago, so insurers must charge more to afford those future payouts.

Despite the increases, earthquake insurance remains available. Building codes now encourage or require seismic retrofits on older homes, and insurers sometimes reward such improvements with lower rates. Homeowners can shop beyond the CEA; some private insurers and mutuals also offer standalone quake policies, sometimes with more flexible deductibles or coverage options. For example, one strategy is to raise your deductible (CEA offers 5%–25% of home value) to lower premiums. An independent agent can help compare CEA-backed plans against private carriers. Notably, experts emphasize that earthquake insurance is still accessible in California, contrasting with wildfire insurance which many struggle to find.

Earthquake risk to California homes is very real: the 1994 Northridge quake in Los Angeles, for example, caused over $20 billion in insured losses and prompted many insurers to stop writing homeowners policies at the time. The state created the CEA in 1996 as a public-private solution to that problem. Even so, only a small share of homes are insured today. Earthquake risk California homes face is growing, but California law does not require owners to buy this coverage. In practice, some lenders might insist on quake insurance if a home is in a high-risk zone or is financed through certain programs, but otherwise it is left to the buyer or homeowner to decide.

Combined Impact on Insurance Costs in Southern California

When a region faces both wildfire and earthquake threats, overall property insurance Southern California becomes costly. Insurers blend all perils (fire, quake, flood, wind, etc.) into their underwriting, so large losses in one category put pressure on premiums in others. For example, insured wildfire losses in California were projected at $35–$45 billion for the January 2025 Los Angeles wildfires alone, and by mid-2025 insurers had already paid out over $20 billion on those claims. Such record losses squeeze insurers’ capital, leading to rate hikes or even solvency concerns. At the same time, Southern California home values are among the highest in the nation – a single wildfire or earthquake event can trigger claims in the billions when expensive homes burn or collapse.

Nationally, recent data show home insurance rates rising by double-digits. In California specifically, filings suggest average premiums could grow by ~20% or more through 2025. Several key drivers explain why insurance costs for homeowners in Southern California are surging:

- High reinsurance and construction costs: Reinsurers (the global backstop for insurers) have sharply increased rates in the past few years. These costs, which nearly doubled since 2017, are now being passed to homeowners. In addition, material and labor costs for rebuilding homes have climbed. Even without a disaster, insurers must set premiums high enough to cover a much higher replacement cost.

- Climate-driven hazard spikes: More intense droughts, longer fire seasons, and stronger storms mean the likelihood of wildfire and flood losses is up. As one analysis notes, homes in Southern California face a year-round mix of risks (wildfire, flood, mudslide) in a climate-change era. Insurers judge that even “moderate” events can cause huge losses in high-value areas, so they account for these extremes in pricing.

- Local risk concentration: Certain Southern California communities (for example, hillside neighborhoods above Los Angeles) have very high exposures. Insurers are charging much more or even refusing some policies for homes in these zones. A homeowner with a house at the bottom of a canyon or on a ridge next to burned brush may face surcharges or a “choose-your-own-adventure” of limited insurer bids.

- Regulatory changes & forward-looking models: California’s new insurance reforms (see below) now allow insurers to use catastrophe models and actual wildfire/reinsurance data. In the short term, that means homeowners in riskier zones will see higher rates than under the old, flatter pricing system. Over time this should encourage new companies back into the state, but in the meantime it keeps prices in high-risk pockets elevated.

Even in lower-risk parts of Southern California there is only modest relief. While some less-vulnerable areas may see premiums level off or even decrease slightly, the average trend is still upward. Surveys of insurance executives predict premium growth will remain positive through 2025 and 2026, given ongoing climate extremes and losses. For example, two large insurers (Mercury and CSAA) were approved to raise rates about 6.9% each in 2026 statewide, and the state’s FAIR Plan has requested a big hike in order to cover its wildfire losses. All told, many Southern California homeowners are already paying hundreds of dollars more per year for the same coverage than they did a few years ago.

California’s Insurance Responses and FAIR Plan

California officials are taking steps to address the crisis. Beginning in late 2024, the Department of Insurance launched a “Sustainable Insurance Strategy”. Under this plan, insurers can now use modern catastrophe models and input actual reinsurance costs when setting rates – but in exchange they must commit to write more policies in high-risk areas. For the first time, regulators are explicitly requiring big insurers to write at least 85% of their statewide policy share in wildfire-affected areas. Similar requirements will be phased in for smaller companies. The intent is to reverse the exodus from risky regions: a department map showed that by mid-2024 the private market had almost disappeared from many fire zones, leaving only the FAIR Plan. By mandating coverage and rewarding homeowners’ mitigation efforts in the new pricing, the state aims to stabilize rates and bring more competition to fire-prone parts of Southern California.

The FAIR Plan is California’s statutorily-mandated insurer of last resort for fire coverage. Homeowners who cannot buy fire insurance elsewhere can turn to the FAIR Plan for basic protection. In recent years its enrollments have exploded as private insurers declined business. However, FAIR Plan policies cover only specifically-named perils (essentially fire and smoke) and pay actual cash value, with no liability or theft coverage. It is expensive: in 2022 the average FAIR Plan policy cost about $3,200 per year, and rates have been increasing (a 15% jump was approved for 2024).

The FAIR Plan itself is now under financial strain. The January 2025 Los Angeles wildfires inflicted an estimated $1 billion in claims on the FAIR Plan. To stay solvent, the state approved the plan’s first-ever assessment on insurers of that size, which will be passed along to homeowners as added fees. This means nearly every California home insurance policy (and many FAIR Plan policies) will carry a temporary surcharge for 2025–2027 to cover those losses. By mid-February 2025, the FAIR Plan had paid over $900 million in claims and had only about $400 million left in cash after the assessment. This bailout highlights how severe the wildfire insurance crisis has become: even the “backstop” insurer is now drawing on billions from policyholders.

More reforms are underway. In mid-2025 Commissioner Lara’s office reviewed several wildfire simulation models and cleared them for use in ratemaking. Companies like Mercury, Allstate, and Farmers have already said they will begin filing to expand homeowners coverage under these new rules. The Department also launched a program of discounts for homes that adopt specific wildfire safety measures. Together, these actions aim to make coverage more available and better priced according to each home’s real risk. Even so, insurance costs for homeowners in Southern California are likely to stay higher than the national average until a more normal balance of supply and demand is reached.

Steps for Homeowners and Homebuyers

For today’s homeowners, the situation means being proactive. If your property is in or near a wildfire zone or a seismic fault, you should:

- Review your coverage: Understand exactly what your policy covers (and doesn’t). Standard home insurance covers fire and some disasters, but not floods or quakes. If you have an older home or one near hills or wooded areas, consider adding or increasing deductible for wildfire or buying an earthquake policy. An independent broker can help compare policies.

- Maintain safety features: As noted, creating defensible space, upgrading to Class-A roofing, and other fire-hardening improvements can make you more likely to keep coverage and may qualify you for insurer discounts. Similarly, retrofitting your foundation or bracing your water heater can reduce earthquake risk and may lower premiums. Keep all receipts or permits in case you need to show insurers.

- Shop around: Get quotes from multiple insurers each renewal. With traditional carriers pulling back, alternative markets like surplus-lines insurers may still offer coverage (though at higher rates). If you can’t find a private company, you can buy from the California FAIR Plan for fire (and a difference-in-conditions policy for other perils), or from the California Earthquake Authority for quake. However, be aware of their limitations (FAIR Plan lacks liability/theft cover, and earthquake policies typically have high deductibles).

- Prepare for non-renewal: If your insurer drops you, act fast. There is a one-year “grace period” after a declared wildfire emergency during which companies cannot cancel or refuse your renewal. If that period passes, immediately seek new quotes. The FAIR Plan remains a backstop, but since it only covers named perils and is under strain, it’s best seen as a stopgap. Documentation of any safety upgrades or mitigations you’ve done will help convince carriers to cover you.

For prospective buyers, buying a home in wildfire and earthquake zones requires extra due diligence. California law requires sellers to disclose if a property lies in one of several hazard zones (high fire severity, floodplain, earthquake fault, etc.). You should also use tools like the state’s online hazard maps (e.g. Cal Fire’s wildfire zone map or the MyHazards site) to check risks. If a home is in a high-risk category, factor in the extra insurance costs. You may want to negotiate price or insist on insurance quotes before closing. It’s wise to plan mitigation into your purchase: creating defensible space and installing fire-resistant materials are not only lifesaving measures, they may keep the house insurable. Likewise, checking for seismic retrofits or installing ones yourself (especially on an older home) can protect you and reduce earthquake premium demands.

Finally, stay informed about state programs. The new catastrophe model rules are rolling out now. In the future, some insurers might offer policies that bundle hazards (for example, some carriers may begin offering flood or earthquake add-ons). Communities are also strengthening building codes and fuel-break projects. Keeping track of these changes can help homeowners get the best available deals. For instance, a buyer learning that an insurer is mandated to take more homes in a certain area might negotiate a better rate or insist that flood/quake coverage be included in the deal.

In summary, wildfire and earthquake risks are putting upward pressure on Southern California home insurance costs. Many homeowners are feeling the pinch through higher premiums, deductibles, or the frustration of fewer insurer options. The state is responding with reforms to stabilize the market, but those changes take time. Until then, homeowners and buyers alike must weigh disaster risk, take practical safety measures, and shop wisely for insurance. The hope is that by better aligning premiums with actual risks – and by reducing those risks where possible – California can create a more reliable and affordable homeowners insurance market for the future.

A Smarter Way Forward Starts With the Right Local Guidance

Wildfire and earthquake risks have changed how people buy, insure, and protect homes across Southern California. Rising insurance costs, limited coverage options, and new regulations mean buyers and homeowners need more than general advice — they need local insight.

Jack Ma Real Estate helps buyers, sellers, and homeowners make confident decisions in high-risk areas. Whether you’re purchasing your first home, reviewing insurance costs, or thinking about selling, having a knowledgeable local team makes a real difference.

If you’re concerned about Southern California home insurance costs, wildfire exposure, or earthquake risks, now is the right time to get clear answers and real options.

Connect with Jack Ma Real Estate today to discuss your goals, understand your insurance challenges, and plan your next move with confidence.

FAQ’s

1. Why are Southern California home insurance costs increasing so fast?

Insurance prices are rising because of repeated wildfire losses, higher rebuilding costs, and earthquake exposure. Insurers also pay more for reinsurance, which raises premiums for homeowners across Southern California.

2. What is wildfire insurance in California, and is it required?

Wildfire coverage is usually part of standard homeowners insurance, but in high-risk areas some insurers limit or refuse coverage. In those cases, homeowners may need California FAIR Plan insurance to cover fire damage.

3. Do I need earthquake insurance in Southern California?

Standard home insurance does not cover earthquake damage. Earthquake insurance Southern California is optional but strongly considered, especially for older homes or properties near fault lines. Most policies are offered through the California Earthquake Authority.

4. What are wildfire risk zones in California?

Wildfire risk zones are areas identified by the state based on terrain, vegetation, and fire history. Homes in these zones often face higher home insurance wildfire risk, higher premiums, or limited coverage options.

5. What should I know about buying a home in wildfire and earthquake zones?

Before buying, check hazard disclosures, confirm insurance availability, and budget for higher premiums. Buying a home in wildfire and earthquake zones often requires extra planning, safety upgrades, and expert local guidance to avoid surprises after closing.