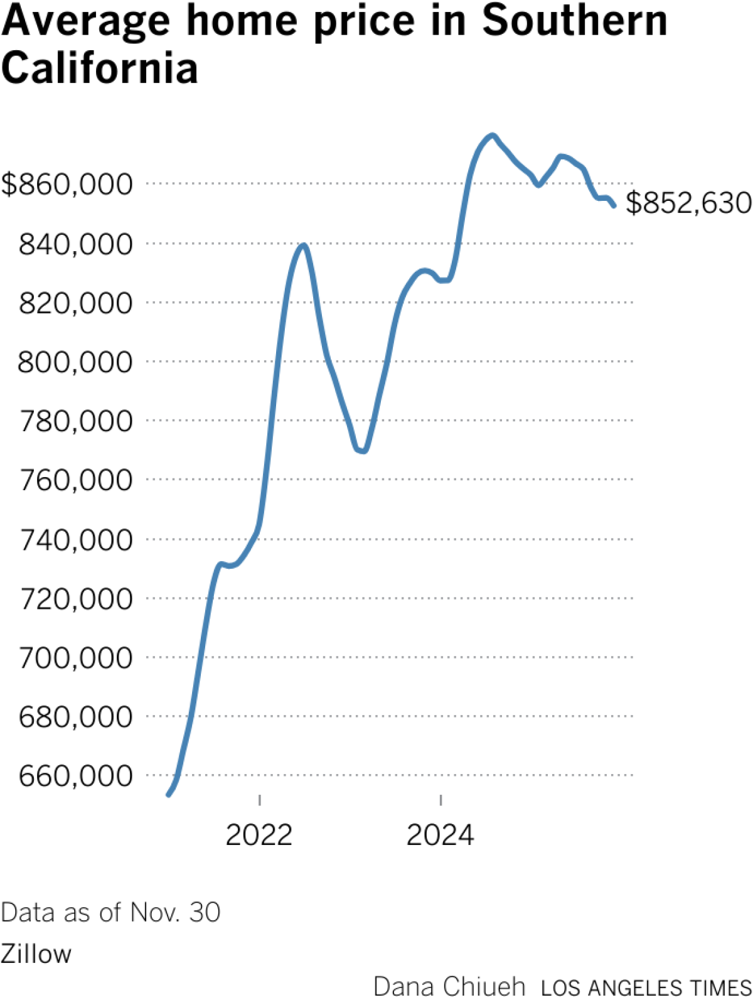

Southern California’s housing market remains one of the most expensive in the nation. By late 2025 the median sale price in the six-county SoCal region was roughly $850,000, well above the national median. In fact, prices nearly doubled the U.S. median price of about $419,000 in late 2025. Recent data show a slight year-over-year decline – for example, Zillow’s data in November 2025 put the average SoCal home at $852,629, down 1.4% from a year earlier but values are still historically high. Inventory has been slowly rising: September 2025 saw about 23% more homes listed than a year before. However, sellers are still reluctant to list properties because many hold ultra-low (sub-3%) mortgages. In short, Southern California home prices are elevated and have only dipped slightly after peaking in 2022–2024.

Chart: Southern California average home price (Zillow/LA Times). This chart shows SoCal prices climbing above $800k in 2022 and remaining around mid-$800k through 2025.

As illustrated above, SoCal prices rose quickly in 2021–2022 and have since fluctuated at high levels. The Los Angeles Times reports that declines in 2023–2024 interrupted months of rising prices, and experts say economic uncertainty (including trade tariffs) has kept buyers cautious. Even modest price drops haven’t opened the market for new buyers. A Times study notes that “first-time buyers remain locked out” because sellers can sit tight on their pandemic-era loans.

Record-High Mortgage Rates

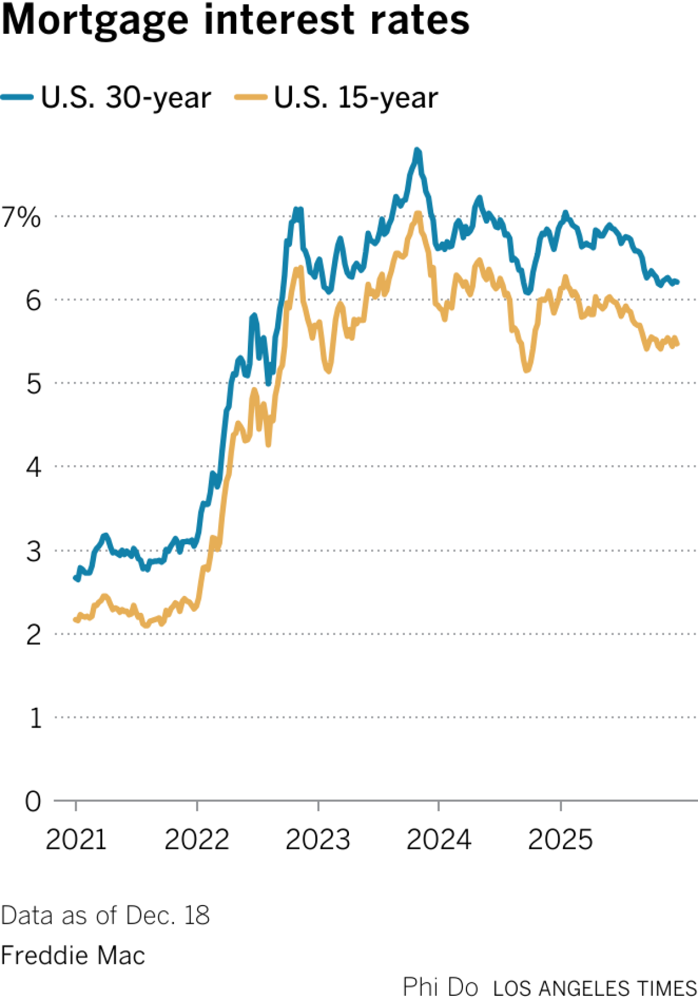

In 2025, home mortgage rates have been far above the lows of recent years. The Federal Reserve’s rate hikes pushed the average U.S. 30-year fixed rate from about 3% in early 2021 to roughly 7–8% by late 2023. By late 2025 rates eased slightly: in December 2025 the 30-year fixed rate averaged about 6.2–6.3%. Regional data are similar – Bankrate reports a 30-year rate ~6.19% in California as of Jan. 4, 2026. These rates remain near their highest levels in two decades. Most analysts expect rates to stay between 6% and 7% in 2026, perhaps averaging around 6.5%.

Chart: U.S. 30-year (blue) and 15-year (orange) mortgage rates. Rates jumped sharply from 2021 into 2023 and have eased back to the low- to mid-6% range by late 2025.

Rising rates directly affect buyers’ costs. The Los Angeles Times notes that mortgage rates averaging above 6% have “knocked many buyers out of the market” in recent years. In fact, one report found that California homebuyers’ monthly payments grew by roughly 74% for a mid-tier home between January 2020 and September 2025, largely because of higher rates. This surge in borrowing costs has made monthly payments much higher than in the pre-pandemic era.

Impact on Home Affordability

High home prices and high mortgage rates together put enormous pressure on affordability. For example, a 30-year loan at 6.2% interest on an $850,000 home (with 20% down) carries a payment over $4,200 per month (principal/interest only) – compared to around $2,500–$3,000 per month at 3% rates. Including taxes and insurance, Los Angeles-area calculations show $5,270 per month for a typical purchase. In one analysis, simply buying a mid-range home in California required over $5,500 per month in total payments by late 2025. By contrast, renters pay much less: renting a 2-bedroom costs about $2,010 more per month on average than owning a home, but that gap has also widened as buying costs soared.

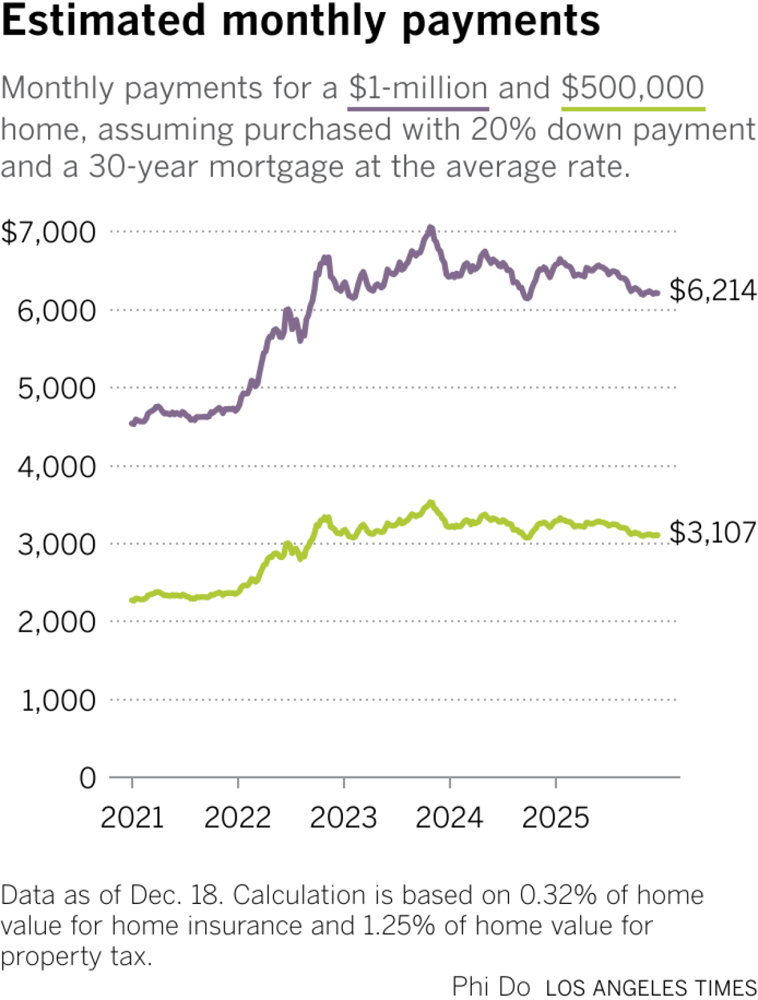

Chart: Estimated monthly payments for a $1,000,000 home (purple) vs a $500,000 home (green) with 20% down. Mortgage payments spiked in 2022–2023; by late 2025 they are roughly $6,200 and $3,100 respectively【17†】.

The chart above illustrates the rise in payments. At today’s rates, the 30-year mortgage on a $1,000,000 home (purple) costs about $6,200 per month, versus roughly $4,000 per month in early 2021. Even a $500,000 home (green) now costs about $3,100 per month, up from $2,000 before rates jumped. These steep payments are often 40–50% of a typical income. For instance, one study notes a $3,240 monthly payment (for the average home nationally) would require an annual income of roughly $139,000 to keep payments under 28% of income. In California, required incomes are far higher: the Cal. Realtors report shows qualifying for a $887,000 median-priced home in late 2025 needed around $223,600 per year. In Los Angeles County specifically, only about 12% of households could afford the median home (requiring ~$240,400 income).

First-Time Buyer Challenges

All these trends converge to make life difficult for first-time buyers. These buyers lack home equity to leverage, so they face the full brunt of prices and interest rates. In Southern California, starter homes are scarce and expensive. By late 2025, Zillow data show first-time buyers “remain locked out” while owners with 2–3% mortgages stay put. There just aren’t enough affordable homes for sale at the lower end of the market.

- High home prices: Even if prices have leveled off, the median SoCal price (~$850K) demands a huge down payment and loan. For example, in the Los Angeles metro area the median home was about $837,000 in Q3 2025. Paying 20% down means $167,400 upfront – out of reach for most young buyers.

- High interest costs: At current rates, monthly payments eat a large share of income. A first-time homebuyer spending 28% of income on housing would need an annual income above $140,000 just to afford a $3,240 monthly mortgage (national estimate). In SoCal, required incomes are even higher. CAR data show the Inland Empire needs ~$150,000/year for its ~$595K median home, and over $210,000 in L.A..

- Limited affordability: Only a small fraction of households can qualify. Statewide, roughly 15–17% of Californian households could afford a median-priced home in late 2025. In Los Angeles and Santa Barbara, that share was just 12%. For comparison, about one-third of U.S. households could afford the national median home.

- Competitive market: Many well-qualified or all-cash buyers are competing. A recent NAR report found first-time buyers accounted for only 30% of U.S. sales in late 2025 – far below their historical 40% share and only 21% in the year from mid-2024 to mid-2025. The typical first-time buyer’s average age is now 40, suggesting that younger buyers have been priced out.

- Rising other costs: Property taxes (around 1.1–1.3% of home value per year) and insurance add to expenses. For a $850K home, taxes alone can be $700–800 per month. These extra costs further squeeze budgets.

- Debt burdens: Many first-time buyers carry student loans or other debt, which limits borrowing capacity. Lenders cap total debt payments, so high student payments can reduce how much mortgage one can take.

Taken together, these factors mean first-time buyers must meet very strict requirements. Even a family earning $150,000 per year (well above SoCal median income) may struggle to afford a suitable home. One expert sums it up: “affordability is unlikely to improve substantially until homebuilding picks up or mortgage rates plummet.”.

Outlook for 2026

What about the near future? Many analysts hope mortgage rates will ease somewhat in 2026. One forecast predicts 30-year rates averaging ~5.5% by year’s end, with local California rates near 5%. Freddie Mac data show the 30-year rate fell to about 6.15% by Dec. 2025. If rates dip into the 5–6% range, monthly payments would fall enough to help some buyers. For example, a $5,106 payment at 6.2% (30-yr on a $832,750 loan) might drop by a few hundred dollars if rates hit 5.5%.

However, any relief may be gradual. Experts caution that slower economic growth and rising unemployment could keep demand soft, which might counteract any boost from cheaper credit. Zillow’s economists project only a modest SoCal price increase (~1–2%) by late 2026. Until new homes are built in significant numbers, supply will remain tight. Thus, Southern California home affordability is expected to stay difficult. First-time buyers may find more homes on the market; one prediction expects listings to increase ~15–20% in 2026, but affordability will still hinge on wages and interest rates.

Clarity, Planning, and Smart Choices Still Matter

In summary, the combination of rising mortgage rates and already-high home prices has squeezed affordability in Southern California. By 2025, SoCal’s median home price around $850K and typical 30-year rates above 6% mean monthly mortgage costs rival or exceed what many households earn. Official indices show that only a small minority of local families can qualify for such loans. As a result, most first-time home buyers in Southern California face serious hurdles. They are often locked out of the market unless rates fall or they can combine high incomes with large down payments. While some relief may come if rates drift lower, current data suggest that home affordability in Southern California will remain a challenge through 2026. Prospective buyers will need to plan carefully, save aggressively, and may benefit from down-payment programs or alternative options (like condos) to improve their chances of entering the market.

Turn Market Challenges Into Real Opportunities

If you are considering buying your first home or reviewing your options in today’s market, Jack Ma Real Estate can help you take the next step with confidence.

Our team focuses on clear data, honest guidance, and real market insight across Southern California. Whether you are assessing affordability, exploring neighborhoods, or deciding if now is the right time to move forward, Jack Ma Real Estate provides support built on facts; not pressure.

FAQs

1. Can first-time buyers afford homes in Southern California in 2025–2026?

Affordability is limited, but it depends on income, location, loan terms, and home type. Condos, townhomes, and inland areas may offer more accessible price points than coastal single-family homes.

2. How do rising mortgage rates affect monthly payments?

Higher mortgage rates increase monthly payments even if home prices stay flat. This is why mortgage rates and home affordability are closely linked, especially for first-time buyers with smaller down payments.

3. Are Southern California home prices expected to drop soon?

Most forecasts suggest prices may level off rather than fall sharply. Limited housing supply continues to support pricing across much of the region.

4. What are the biggest first-time buyer challenges in California?

The main challenges include high down payments, strict lending requirements, rising insurance costs, and competition from well-funded buyers.

5. Is buying a home in Southern California still better than renting?

This depends on how long you plan to stay, your financial stability, and local rent levels. For some buyers, renting remains cheaper short term, while ownership may provide stability over time.