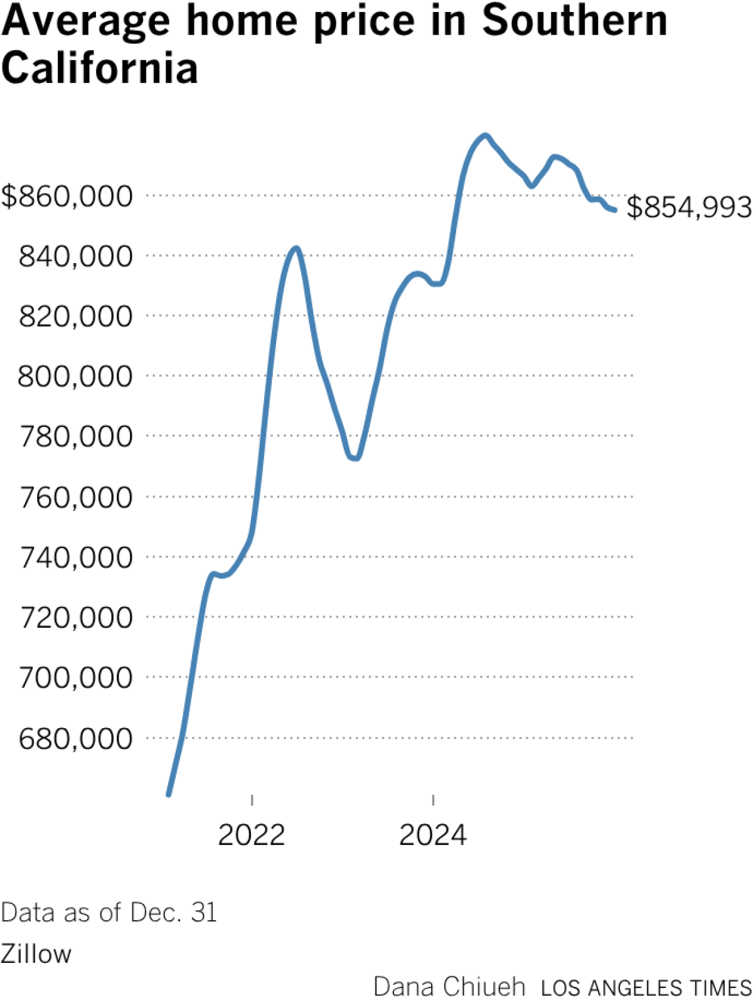

Southern California home prices remain high but have eased slightly from their pandemic surge. According to Zillow data, the average Southern California home price fell to about $855,000 in December 2025, the lowest level since early 2024. Overall trends show only modest gains ahead: Zillow predicts roughly +1.2% price growth in L.A. next year, and the California Realtors’ Association forecasts a 3.6% rise statewide by 2026. Even so, California’s housing costs are still much higher than most of the country: a mid-tier California home is about $755,000 (over twice the U.S. mid-tier price). High mortgage rates (around 6–7%) continue to slow demand, but rising inventory is giving buyers more options.

By late 2025 Southern California’s average home price had settled around $855,000, down slightly from mid-2023. The chart above (Zillow data) shows SoCal prices plateauing after early-2023. Key market takeaways:

- SoCal median price: ~$855K (Dec 2025).

- Forecast: Modest gains (L.A. +1.2% per Zillow; CA +3.6% per C.A.R. in 2026).

- State context: California mid-tier home ~$755K (2025), highlighting steep costs.

- Mortgage rates: ~6–7%, keeping buyers cautious.

- Supply: Inventory is rising (e.g. OC supply ~3.9 months as of mid-2025), giving buyers more negotiating power.

Interest rates remain a brake. This chart shows U.S. 30-year mortgage rates peaking near 7% in 2023 and staying around 6% into early 2026. High borrowing costs mean many owners with ~3% mortgages are holding off, limiting new supply. That said, sellers are gradually adjusting. In Riverside and San Bernardino, for example, home value growth has slowed to just +1.1% (2025) and price cuts are up, turning it into a more buyer-friendly market. Overall, experts say the SoCal housing market is stabilizing. Buyers have more time and leverage than in recent years, even as California’s long-term appeal – limited land and steady demand – suggests values should hold up.

Los Angeles County & Nearby

Greater L.A. has the highest prices in SoCal, but even here a few entry points remain. As of early 2025 the median single-family home in L.A./Orange Counties was about $1.16M, up ~10% year-over-year. Condos/townhomes are cheaper (~$700K median) and have more listings (inventory +32% from 2024). For buyers on a budget or first-timers, look at the following Los Angeles neighborhoods:

- El Sereno (East L.A.): A quieter neighborhood near South Pasadena, with a median home price around $740K. Tree-lined streets and hillside views give it character.

- Highland Park (Northeast LA): Trendy and walkable, with mid-century homes and craft bakeries. Median price ~$775K, still well below coastal L.A. areas.

- North Long Beach: South of downtown LB, benefiting from public investments. Median price ~$675K for post-war single-story homes. Good freeway access and community feel.

- Panorama City (San Fernando Valley): Centrally located, close to jobs and transit. Median price ~$670K. Improved retail and schools are adding value.

- Lawndale (South Bay): While pricier than the above, Lawndale’s median (~$915K) is still below many coastal L.A. areas. Its affordable beach-proximity makes it a hidden gem.

In these areas, young professionals and families can find good value. (By contrast, LA’s coastal neighborhoods and Westside often have medians in the millions.) First-time homebuyer Southern California programs and financing can help stretch budgets here, especially in condo or townhouse markets where inventory is up and prices rose only ~7% in 2025. In short, even the best places to buy a home in Southern California (like top LA suburbs) have affordable pockets – focus on neighborhoods with improving amenities and schools.

Orange County

Orange County’s market remains expensive (2025 median ~$1.18M), but inland cities offer relatively more value. Notably:

- Santa Ana: Often cited as OC’s cheapest city, with denser housing and older neighborhoods. Many condos and modest homes sell well under OC’s median price. It has a vibrant downtown and appeals to urban-style first-time buyers.

- Anaheim: A balance of amenities and affordability. Many post-war single-family homes and condos here remain below the county average. Good schools and transit (plus Disneyland jobs) make it a solid investment area.

- Garden Grove: Less in the spotlight, so prices stay accessible. Predominantly older homes without a lot of new luxury construction. Expect stable neighborhoods and proximity to freeways.

- Buena Park: Inland and on the OC/LA border. Offers more bang for your buck than central OC. It has entertainment (Knott’s Berry Farm), accessible freeways, and mid-century homes at moderate prices.

- Stanton: The smallest city in OC, with the lowest price points. Mostly condos and townhomes, but a step into homeownership here costs much less than on the coast.

These neighborhoods are examples of affordable SoCal neighborhoods in Orange County. They tend to have older housing stock or more attached homes. (By contrast, cities like Irvine or Newport Beach have medians well above $1.5M.) Buyers in OC looking to invest or get a first home should consider these inland areas and also keep an eye on expanding Master Planned Communities (e.g. near Ontario Airport or in Northern OC).

San Diego County

San Diego’s median price (~$960K in mid-2025) remains high, but certain areas offer better values:

- Lemon Grove: Just east of downtown San Diego. Small-town feel with improving shops, and median home ~$625K. Commuters love its trolley link to UCSD and downtown.

- Barrio Logan: A cultural hub south of downtown. Median home ~$980K (still below city’s $1M+ areas). Its art scene and new housing keep it on the rise.

- City Heights: Inland central city with great diversity. Homes here are still relatively affordable compared to coastal or beach areas. Ongoing transit and community projects are lifting its profile.

- Logan Heights: Neighboring Barrio Logan, it has even lower prices and is attracting renovation. With new businesses and streetcar plans, it’s worth watching.

- Encanto: Families and remote workers move here for larger lots without leaving the city. The cost is higher than City Heights but still reasonable for SD, with good schools and parks.

In short, up-and-coming neighborhoods in Southern California like these San Diego areas combine value with growth potential. Local data shows San Diego shifting to a buyer’s market in 2025: the median home sold for about 98.3% of list price (i.e. often below asking) and days on market have roughly doubled. That means savvy buyers and first-time homebuyers in Southern California can take advantage of more negotiation room here.

Inland Empire (Riverside & San Bernardino Counties)

The Inland Empire remains the most affordable large region in SoCal and is growing rapidly (though growth has cooled). In 2025 home price growth slowed to about +1.1% year-over-year, reflecting a correction from the big gains of 2021–22. However, that means more inventory and price cuts than before, putting buyers in the driver’s seat. Key neighborhoods to consider:

- Orangecrest (Riverside): Family-friendly area near good schools. Median home price ~$479K. Quiet suburban streets and parks make it attractive for value.

- University (Riverside): Near UC Riverside. Median ~$323K, making it one of the most affordable Riverside neighborhoods. Good transit access (freeways, buses, Metrolink) adds appeal.

- Victoria (Riverside): Historic, leafy area with slightly higher prices (~$440K) but still far below coastal LA. Large lots and long-term growth (orange groves, the old railroad) give it unique charm.

- Ontario Ranch (Ontario, SB County): A new master-planned community. Homes are still relatively affordable for modern suburban developments. It's next to job centers (warehouses) and near the airport.

- Eastvale/Gypsum Canyon (Riverside County): Rapidly developing suburbs (formerly part of Corona). Quality schools, new retail, and lower tax rates. Median homes are in the $700K–$800K range, with room to grow.

- Fontana (SB County): Logistics hub with many distribution centers. It has seen steady demand but remains lower-priced than L.A. or Orange County. New housing and proximity to freeways make it a good entry point.

- Redlands/Kendall Hills (SB): Modest single-family neighborhoods that have seen strong 2024–25 growth (+8.5% YOY). Local revitalization (new shops, renovated parks) suggests more upside.

These neighborhoods with growth potential in SoCal offer the space and price entry that many buyers seek. Inland Empire’s average prices (often 60–70% below L.A. levels) combined with new jobs and homes are a draw. In fact, agents note that IE is increasingly attractive because it’s more affordable than LA/OC. For a first-time homebuyer or investor, places like Ontario Ranch, Eastvale, and Redlands can yield equity as the region develops. And as Inland Empire builds out, even rent-ready homes (ADUs, multifamily) are opening up cash-flow deals that are rare closer to the coast.

Take the Next Step with Jack Ma Real Estate

Ready to turn these insights into action? Jack Ma Real Estate can guide you to Southern California’s most promising buys. Whether you’re a first-time homebuyer Southern California or an investor eyeing growth, our local experts will help you spot value in the right neighborhoods. Don’t wait, high-quality homes and land are scarce in SoCal, but opportunities exist right now in affordable areas. Contact Jack Ma Real Estate today to find your dream home or next investment in Southern California’s up-and-coming markets. Start building equity and community in SoCal’s future!

FAQs

1. What are some affordable neighborhoods in Southern California?

In general, look inland and east. In Los Angeles County, neighborhoods like Panorama City, North Long Beach, El Sereno, and Highland Park have lower median prices. In San Diego County, try Lemon Grove, Barrio Logan, or City Heights. In Orange County, Santa Ana and parts of Anaheim or Garden Grove offer more affordable entry points. And in the Inland Empire, places like Riverside (Orangecrest, University) and San Bernardino (Del Rosa, Kendall Hills, Fontana) remain much cheaper than coastal areas.

2. What are current Southern California real estate trends?

After a mid-2020s surge, SoCal home prices have largely stabilized or dipped slightly. By late 2025 the average SoCal home was around $850–$900K. Sales volume is lower and homes are staying on the market longer, giving buyers more negotiation power. Experts forecast slow growth (single-digit gains at best) in 2026 rather than big jumps. Meanwhile, higher mortgage rates have kept many owners locked in place, so inventory is gradually rising – a trend that should continue easing the market.

3. Is it a good time to buy a home in SoCal?

The market is less frenzied than in 2020–22, so buyers have a better chance now. Prices aren’t dropping dramatically, but many sellers are now realistic about pricing, and interest rates have started to ease. For buyers who can afford it, there’s more choice and less bidding war pressure than before. As with any market, timing can vary by neighborhood: the above areas may offer “sweeter spots” right now. The key is to stay pre-approved, act when you find a good deal, and work with local agents who know which neighborhoods have growth potential.

4. What should a first-time homebuyer consider in Southern California?

Affordability is the biggest factor. Consider smaller homes (townhouses or condos), newer suburbs, or neighborhoods in transition. Check if you qualify for any first-time homebuyer programs in CA (some cities/counties offer assistance). Also factor in total costs: high tax and insurance areas (fire zones) add up. Look for neighborhoods near transit or job centers to lock in convenience value. Because SoCal home prices are high, many first-timers team up with Realtors (like Jack Ma Real Estate) early to get ready and spot deals as soon as they appear.

5. What are the best places to buy a home in Southern California for investment?

Historically, land scarcity and consistent demand mean SoCal real estate tends to hold value. For investment, growth areas include: the Inland Empire (rents and jobs are rising), parts of East LA/Valley, and some Orange County suburbs on the upswing. Emerging neighborhoods with new infrastructure or redevelopment (like parts of San Diego or Riverside) can produce strong appreciation. Focus on markets where rents are stable or rising (such as near universities, transit, or logistics centers). Always analyze local data, but neighborhoods mentioned above (e.g., Canyon Crest/Orangecrest Riverside, Del Rosa SB, Lemon Grove SD) combine affordability with potential; ideal for SoCal property investment.