Southern California’s housing market remains a hot topic amid debates over corporate landlords and rising prices. Headlines have blamed institutional investors buying homes (large firms buying single-family houses to rent out) for exacerbating the affordability crisis. Governor Gavin Newsom and former President Trump have both proposed limits on these buyers, suggesting they “snatch up” homes that families want. In practice, experts note that big investors actually own a small slice of the market. For example, by mid-2022 institutional landlords held roughly 450,000 U.S. single-family rentals (about 3% of all single-family rental homes). In California the share is similarly low: a state report found fewer than 3% of single-family homes are owned by companies with 10 or more properties. In other words, the vast majority of California homes remain in private hands, not in corporate portfolios.

Key data points on the SoCal housing market and investor activity include:

- A California research report found large investors own under 3% of all single-family homes statewide.

- Nationwide, about 3% of single-family rentals are held by institutional landlords (roughly 450,000 homes).

- Recent data show investors purchased about 26.8% of home sales in California in Q1 2025, a record high share largely because overall sales plunged, not an investor buying spree.

- In Southern California, investor purchases were around 24% of homes sold in early 2025 in both Los Angeles and San Diego.

- Most investor-owned homes belong to small landlords: 85% of these portfolios have only 1–5 properties.

These figures show that institutional or corporate buyers are players in the Southern California market, but not a dominant force. What does this mean for local buyers? Below we examine the trends, the impact on prices, and what experts say about affordability in the region.

Who Are Institutional Home Buyers?

Institutional investors generally refer to large companies or funds such as real estate investment trusts (REITs), private equity firms, and corporate rental companies that buy homes en masse. After the 2008 housing crash, firms like Invitation Homes (a REIT spun out of Blackstone), American Homes 4 Rent, and Progress Residential began buying thousands of single-family houses to rent out. They targeted areas with moderate home prices and growing demand. Invitation Homes, the largest U.S. single-family rental landlord, owns over 11,000 homes in California (about 3,100 of them in L.A. County). Similarly, Blackstone and others amassed portfolios nationwide.

However, California’s expensive coastal market is not the typical focus for these investors. As the California Research Bureau notes, “that doesn’t describe California,” so larger investors make up a relatively small share here. In fact, Invitation Homes and the other big REITs tend to operate more in Sun Belt cities and affordable suburbs. Southern California does have institutional activity, but much of the rental stock is also owned by local or “mom-and-pop” landlords. According to a California policy analyst, the rise of Wall Street investors in single-family homes “was really a symptom of the affordability crisis” rather than a cause of it. Large companies did invest in SFR (single-family rentals) after 2008, but analysts point out that the footprint of those corporate buyers in California is still small.

Recent Trends in the Southern California Housing Market

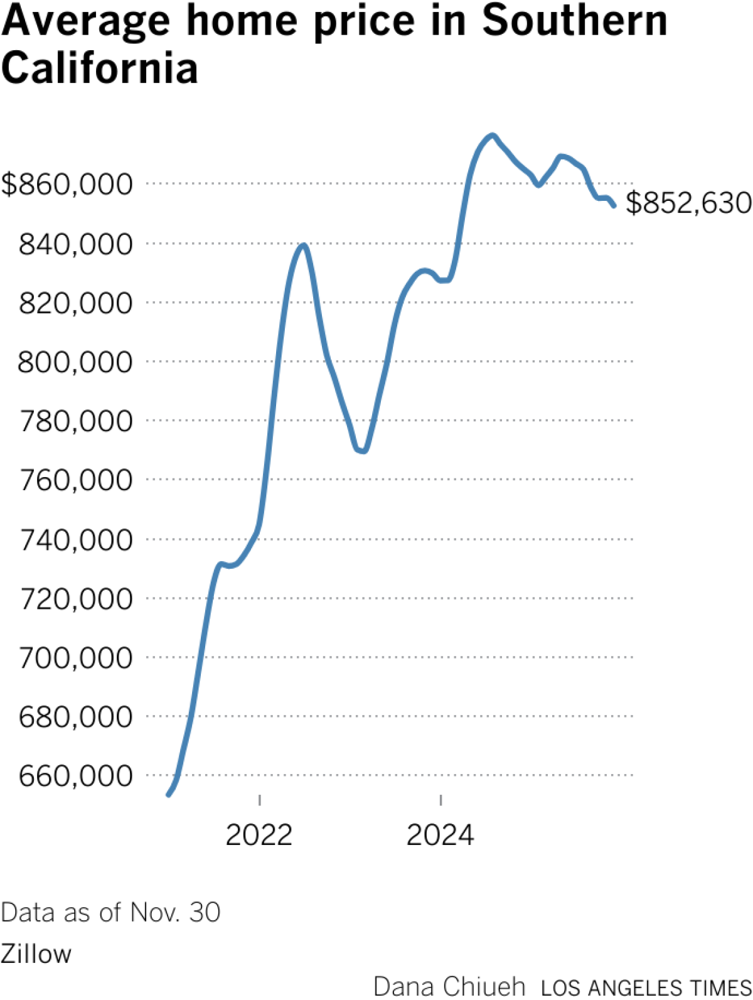

The Southern California housing market has cooled off in recent years after a post-pandemic surge. Median home prices in the six-county region have dipped from their summer 2024 highs. In November 2025 the typical single-family home in Southern California sold for about $852,630, down roughly 1.4% year-over-year. Rising mortgage rates and economic uncertainty have slowed demand. Sellers who locked in ultra-low mortgage rates during the boom have been reluctant to list, tightening supply

.

.

Chart: Southern California’s median single-family home price was about $852,630 in Nov 2025, marking a continued slight decline. In this market, some expert surveys and media trackers note that first-time buyers remain largely “locked out” of the competition. Homeowners with very low (under 3%) mortgage rates have little incentive to sell, so inventory remains low. Zillow and other analysts predict that if the economy avoids recession, prices may stabilize or inch up, but the immediate trend in late 2025 was flat-to-down.

For investors, higher interest rates and high home prices have reduced some of the earlier momentum. A Redfin economist noted that across the U.S. (including California), investor purchases have been relatively stable with only modest quarter-to-quarter swings in 2024–2025. Their share of sales nationally was about 19% in early 2025. In Southern California specifically, Redfin’s data show investors accounted for roughly 24% of homes sold in Los Angeles County and 24% in San Diego County during the first quarter of 2025. (By comparison, markets with more affordable housing often saw lower investor shares, and some smaller California metros had even higher shares.) These percentages are historically high but have more to do with slumping purchases by homeowners than a new wave of corporate buying. In short, fewer regular buyers were active, so investors made up a larger slice of the shrinking pie.

In fact, recent reports indicate that large institutional investors have been pulling back. Nationwide, Blackstone reported in early 2025 that institutional homebuying has declined by about 90% since 2022. One analysis found that in Q1 2025 big investors sold about 76% more properties than they purchased, while smaller landlords (owning 1–5 homes) drove the remaining investor purchases. In Southern California, this means that while investor activity remains significant, much of it comes from smaller rental buyers or individual investment homes, rather than huge funds.

Investor Presence by the Numbers

- Small share of housing stock: Studies agree that institutional landlords own only a small fraction of California’s homes. A California Research Bureau analysis found just 2.8% of single-family homes in the state are held by owners of 10 or more units. Statewide, only about 20,066 houses are owned by firms with portfolios of 1,000+ homes.

- Investor-owned California homes: Another data report concluded that nearly 20% of California homes have some investor ownership (including very small investors and LLCs). Even this higher figure contrasts with much lower percentages in the biggest markets. In Los Angeles County, about 15% of single-family homes are investor-owned; in Orange and San Diego counties the number is about 16%. In comparison, rural and resort counties can have investor rates above 60–80%.

- Investor share of purchases: Analysts tracked home purchase records to see how many sales went to buyers tagged as “investors.” In Southern California, those tagged as investors bought approximately 24% of homes in Q1 2025. This was a peak period for investor share. By contrast, a broader national measure found investors buying roughly 19% of homes in that quarter. These investor shares were elevated mainly because conventional buyers backed away due to rates and prices.

- Dominance of small investors: Crucially, most of the “investors” in these stats are small-scale. One analysis found 85% of investor-owned homes nationwide belonged to owners of only 1–5 properties. Big firms (with hundreds of units) account for a minority. As a result, many of the investor purchases in Southern California are likely by local landlords or family offices, not necessarily massive institutional portfolios.

Together, the data suggest that corporate investors are indeed active, but their footprint is limited. In real terms, the typical Southern California neighborhood is still mostly owner-occupied homes. The chart above shows how home prices have eased slightly, reflecting broader market conditions more than a specific boom or bust driven by Wall Street.

Impact of Investors on Home Prices and Affordability

A key question is whether institutional buying is driving up home prices. Researchers say the answer is mixed. On one hand, when investors convert owner-occupied houses into rentals, they do reduce the number of homes available for sale. That can squeeze supply and push sale prices higher. A University of Texas economist summarized this view: investor purchases take homes off the market, which can raise prices for remaining buyers. On the other hand, those conversions do add rental housing, which can ease pressure on the rental market. In fact, studies often find that adding single-family rentals tends to put downward pressure on rents, which helps renters (even as it makes homebuying tougher).

California’s housing shortage is widely acknowledged as the main driver of high prices. UC Berkeley and USC analysts emphasize that supply constraints and strong demand - not investors per se - are the core issue. As one expert put it, removing institutional buyers probably wouldn’t meaningfully reduce competition: most homes are still bought by people planning to live in them. Indeed, if corporate buyers paused, the main competition for buyers would remain other buyers, especially those with cash or high equity. In short, limiting investors alone wouldn’t magically create more houses for families, given how dire the supply gap is.

Nonetheless, even a modest share of buyers competing with homeowners can feel significant in a tight market. In Southern California’s price-sensitive areas, some first-time buyers report getting outbid by all-cash investor offers. Anecdotally, families say losing bids to investors who can skip financing has been “heartbreaking,” particularly at lower price ranges. One local first-time buyer shared that an all-cash investor won their bid, highlighting the emotional impact on community members. Realtors note that institutional investors often target entry-level and mid-range homes that could otherwise go to young families (for example, homes in the $500k–$800k range in some South Bay or Inland Empire markets).

On affordability, the presence of investors is a double-edged sword. Critics argue investors bid up prices and keep homes in the rental market, making it harder for families to buy. Supporters respond that single-family rentals provide housing to those priced out of buying, often in nicer neighborhoods than the average rental stock. For Southern California, where rents are also high, expanding the rental stock with quality homes could help some households. Some industry statements emphasize that corporate landlords see themselves as complementing the market by offering well-maintained rentals and pathways to homeownership through future tenant purchase options. In practice, however, most experts agree that the overall solution lies in building more homes. As one housing economist commented, affordability “must focus on policies that address the root cause: inadequate housing supply”.

Who Is Buying Homes in Southern California?

Outside of institutional firms, a wide range of buyers populate the Southern California market. According to recent surveys, first-time homebuyers nationally have fallen to historic lows and only about 21% of U.S. buyers in 2024–25 were first-timers. This suggests many SoCal buyers are “move-up” households or investors rather than entry-level families. High mortgage rates and low inventory mean that many current homeowners hold on to low-rate mortgages instead of selling, tightening supply for everyone.

In Southern California, major buyers include:

- Young families and middle-aged homebuyers seeking to upgrade or relocate. They often compete fiercely and may need larger down payments to win.

- All-cash investors and iBuyers. Some Wall Street or tech-driven firms like Opendoor (iBuyer) do operate in parts of California, snapping up homes to flip or rent. These are more active in certain price tiers.

- Local and foreign investors. In popular neighborhoods (e.g. coastal or luxury areas), foreign and out-of-state investors sometimes buy second homes or investment properties. These purchases tend to be at the high end of the market.

- Renters converting to buyers. A portion of investors are actually former renters or homeowners turning investors by purchasing additional homes. Many “investor” buyers are smaller operators, not huge firms, so they may be local families with some extra cash buying one or two rentals.

Therefore, when people ask “Who is buying homes in Southern California?”, the answer is: Mostly other homeowners and small-scale investors. Institutional buyers represent only a slice. For example, Los Angeles County had about 72,500 homes held by large investors (including condos and duplexes) out of over 1.8 million single-family houses. That’s a very small share. The rest are people buying for themselves or smaller investors.

Navigating Affordability and Next Steps

With home prices high (Southern California’s median single-family price around $850K in late 2025), housing affordability in Southern California remains challenging for many. Institutional buyers have been blamed politically for squeezing prices, but the data suggest they are not the main culprits. Instead, analysts point to chronic underbuilding: the number of homes for sale is far below demand, driving up costs for everyone.

For an individual buyer or seller, what matters is understanding the market and finding help. Even in competitive segments, opportunities exist. Realtors recommend working with experienced local agents who know where supply may be improving (for example, new developments or areas with rising listings). It also helps to be pre-approved for financing and ready to move quickly. In neighborhoods where investors have been active, sellers may sometimes entertain offers from first-time buyers with flexible terms.

Bottom line: Institutional investors are still part of the Southern California housing landscape, but their role is smaller now than the media hype might suggest. They remain active in certain niches (especially single-family rentals), but large firms have eased off. The biggest factors keeping prices high are still the overall lack of inventory and strong demand from traditional buyers. For home shoppers, the key is to treat investors as just one of many competitors and focus on what you can control your financing, your offer strategy, and working with a knowledgeable Realtor.

Take Action with Jack Ma Real Estate

Ready to make the Southern California housing market work for you? Jack Ma Real Estate is here to guide your journey. Our team of experienced agents understands the local market inside and out. We can help you find single-family homes in the communities you love, or market your home to qualified buyers. Whether you’re competing against other families or facing investor cash offers, we know how to negotiate the best deal. Contact Jack Ma Real Estate today for a free consultation. Your dream home is within reach, and we’ll help you seize it.

Don’t wait on the sidelines. Reach out to Jack Ma Real Estate and let us put our expertise to work for you. Visit our website or call us to start exploring listings and market insights tailored to your needs. Your homeownership goals are our priority.

FAQ’s

Q: Are institutional investors still buying single-family homes in Southern California?

A: Institutional investors (big companies and funds) are active but not as dominant as headlines might suggest. Data show that large investors own only a small share of single-family homes in California (under 3%). In SoCal markets, investors did buy about 20–25% of homes in some recent periods. However, much of that activity comes from smaller landlords and is influenced by broader market trends (like higher mortgage rates) rather than a continued investor “buying spree.”

Q: How many Southern California homes are owned by institutional investors?

A: Very few in percentage terms. A California research report found just 2.8% of the state’s single-family homes are owned by investors with 10 or more units. In Los Angeles County, that means roughly 15% of SF homes have any investor ownership. The vast majority of homes are owned by individuals or small landlords.

Q: What impact do investors have on home prices in Southern California?

A: Institutional investors can influence prices by competing in auctions and taking homes off the sale market. This can put upward pressure on prices for entry-level homes. However, their overall impact is considered limited compared to the bigger issue of supply shortage. When investors rent a house, it also adds to rental supply, which can help rents. Most analysts agree that building more homes is the most effective way to improve affordability.

Q: Who is primarily buying homes in Southern California?

A: Aside from investors, Southern California homes are mostly bought by local families, individuals moving up, and some high-end buyers (including foreign buyers in luxury markets). First-time buyers nationally are a smaller share than before (around 21% recently), so many buyers here are either repeat buyers or cash purchasers. Small-scale investors (landlords with 1–5 homes) also account for a significant portion of investor buying.

Q: How does investor activity affect housing affordability in Southern California?

A: Investor buying can make it harder for some potential homeowners by increasing competition and reducing available inventory. That said, experts argue it’s more of a symptom than the root cause of unaffordability. Affordability in Southern California is primarily hampered by very low supply and high demand. Curbing investor purchases alone won’t solve that. For buyers, the focus should be on finding the right financing and strategy to compete in a tight market, and on supporting policies that increase housing supply.