Hello everyone, this is Jack Ma from Century 21 Masters. We just received the data for June, and there’s some very interesting information to share with you regarding the Southern California real estate market.

Market Data Overview

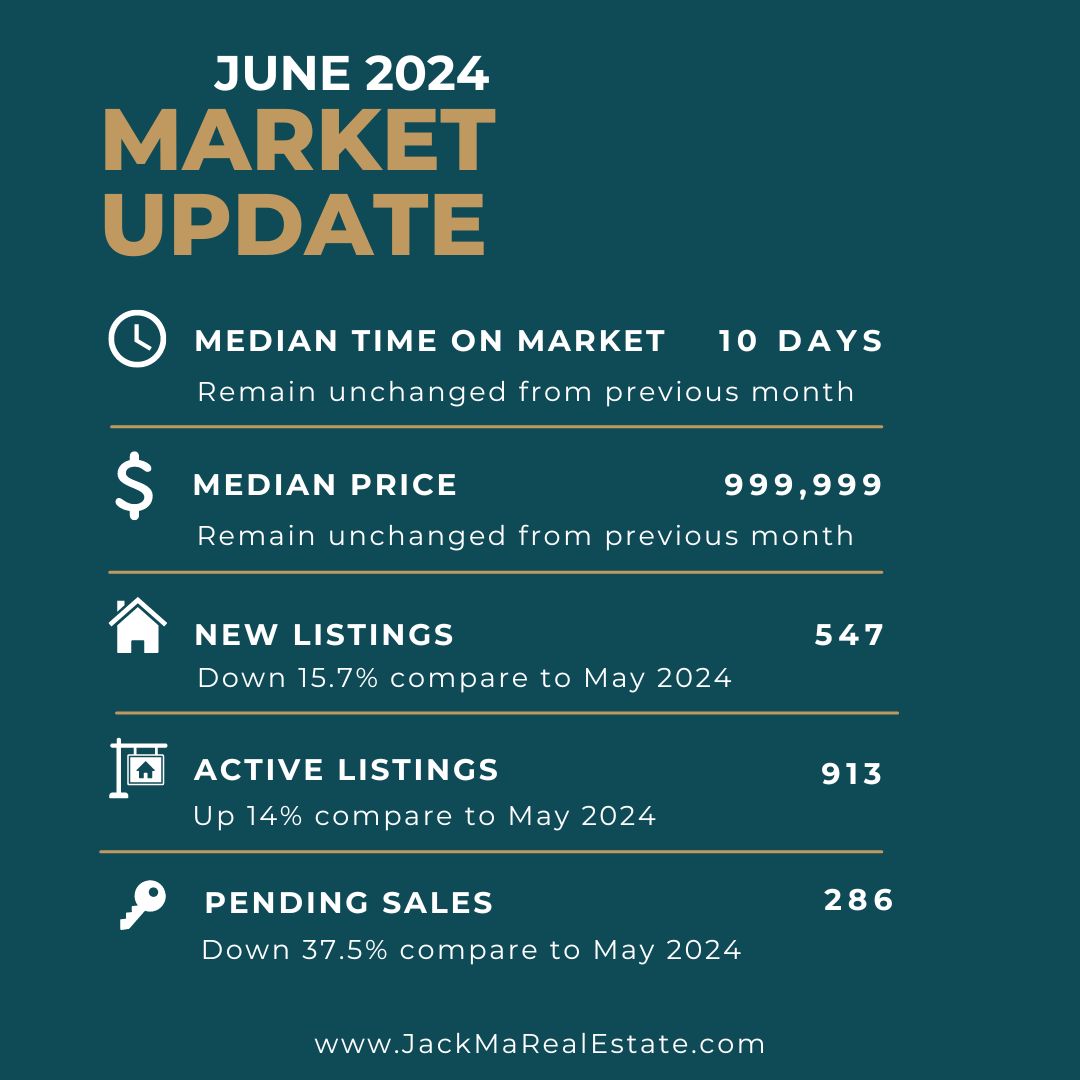

From January to June, we’ve seen prices appreciate by almost 15%. However, most of this growth happened between January and April. In the typically hot months of May and June, prices have remained flat, indicating that we might be starting to see a plateau.

Market Trends

This shouldn’t come as a surprise if you’ve been following my updates. We’ve seen inventory increase for three straight months and pending sales decrease significantly in the last two months. All of this points to the market starting to slow down.

Explanation

Why is this happening, you might ask? Isn’t inventory still super low? The answer is simple: buyer demand is directly tied to affordability. With interest rates remaining around 7% and prices continuing to rise, affordability has dropped. It’s just getting too expensive.

Market Outlook

Now, you might wonder if the housing market is going to crash. Let me assure you, it will not. While the market will likely continue to cool down until we see interest rates drop more noticeably—and this could happen soon—unemployment is ticking upward, retail sales are sluggish, and inflation is flattening. We’re expecting at least one interest rate cut this year.

Financial Impact

Did you know that for every 1% drop in interest rates, a buyer’s monthly mortgage payment drops by 10%, or they can borrow 10% more? This will bring more buyers into the market and create more competitive bidding situations.

Future Predictions

According to the National Association of Realtors, home prices are expected to keep rising over the next five years, but at a healthier and more sustainable pace of around 2–5% annually. This steady growth signals a more balanced market, giving buyers time to plan and sellers confidence in long-term property value appreciation.

Advice for Buyers

So what does this mean for buyers? If home prices are expected to continue rising, entering the market sooner rather than later can be a smart move, even with higher interest rates. Many buyers choose to purchase now, build equity, and refinance later when rates become more favorable.

Advice for Sellers

For sellers, timing matters more than ever. As the market begins to cool, listing sooner rather than later can help you capture current buyer interest. Since home prices tend to lag behind market shifts, we may not see meaningful price recovery until next year.

Conclusion

Thank you for reading our June 2024 Southern California real estate market update. If you have any questions or need personalized advice, please don’t hesitate to reach out. Don’t forget to like, share, and subscribe for more market updates and real estate tips. See you next time!